Smishing is a type of scam where fraudsters use SMS to trick individuals into divulging sensitive information or making payments. This scam can result in significant financial losses and can have a serious impact on your personal security. Here we will explore what smishing is, how it works, and what you can do to protect yourself.

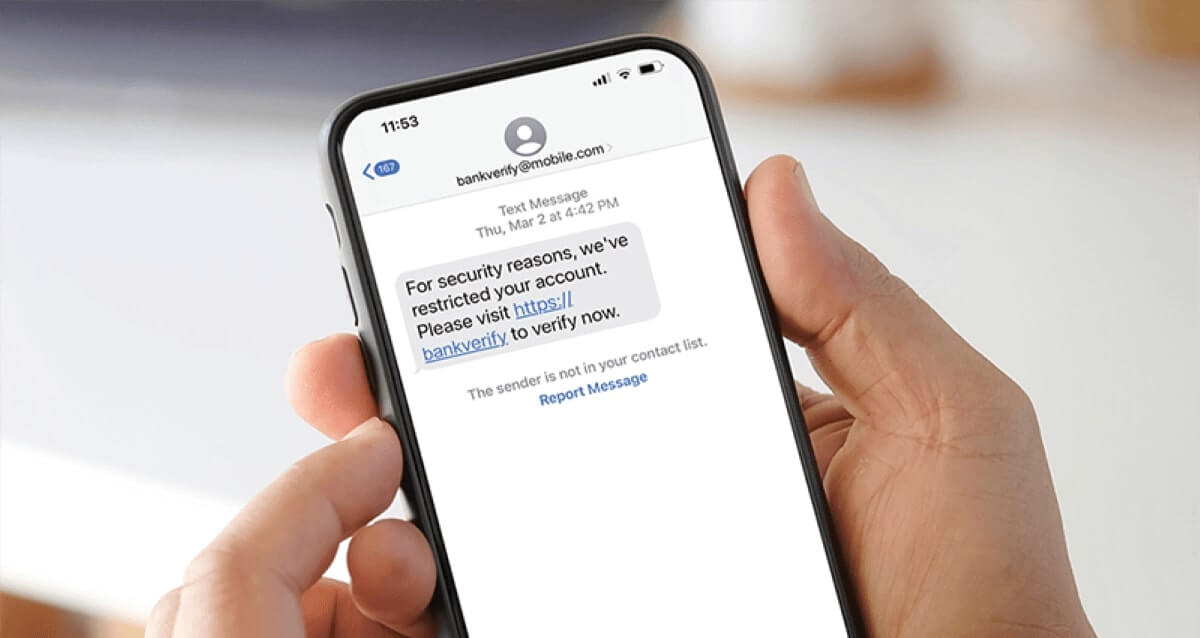

This scam typically involves the sending of malicious text messages, often claiming to be from a trusted source such as a bank or government agency. The text message may contain a link to a fake website or ask the recipient to reply with personal or financial information.

The fraudster may use scare tactics to convince the recipient to respond quickly, such as threatening to freeze their bank account or suggesting that there is a problem with their tax return. Once the recipient has provided the requested information, the fraudster can use it to commit identity theft or make fraudulent transactions.

Smishing is a growing problem in the UK. According to the latest data from Action Fraud, the UK’s national fraud reporting centre, there were over 166,000 reports of smishing in 2020, with losses totalling £479 million. The average loss per victim was £2,853.

In order to prevent smishing you should also be cautious of any links contained in text messages. If you receive a text message containing a link, always verify the identity of the sender before clicking on the link. You can do this by contacting the supposed sender directly using a phone number or email address that you know to be genuine.

It’s also a good idea to enable two-factor authentication on all of your accounts in order to prevent smishing. Two-factor authentication requires you to enter a code that is sent to your phone before accessing your account, providing an additional layer of security.

If you do become a victim of smishing, it’s important to report the smishing attempt to the police and your bank or mobile phone provider immediately. The sooner you report the scam, the more likely it is that the authorities will be able to recover your funds or prevent the fraudster from targeting others.

Smishing is a serious issue that can have devastating consequences for its victims. By understanding how smishing works and taking steps to protect yourself, you can avoid falling victim. Remember to be cautious of unsolicited text messages, links contained in text messages, and anyone who asks for personal or financial information over text messages. If you do become a victim, don’t hesitate to report the crime to the police and your bank or mobile phone provider.

With billions in damages yearly, falling victim can devastate your finances and mental well-being. Take control of your financial security today.

Watch Your Pocket® is a team of experts dedicated to raising awareness about fraud and equipping individuals with the knowledge and tools they need to protect themselves.