Martin Lewis is Britain’s most trusted money expert. Scammers know his reputation draws attention, so they use his name and face to lend weight to fake schemes. Over the years, he has warned of adverts that misuse his image to sell dodgy crypto and bogus investments. Despite these alerts, fraudsters find new angles. Their latest target is a vulnerable group known as WASPI women.

WASPI Women Face New Scams

WASPI women were born in the 1950s. They saw their State Pension age increase faster than expected. Many felt blindsided by poor communication from successive governments. When the Work and Pensions Secretary confirmed there would be no compensation, frustration turned to desperation. Scammers seized this moment. They offered a so-called “WASPI compensation calculator” and claimed Martin Lewis himself endorsed it.

The promise of lost pension payouts proved irresistible to some. Women entered personal details in hopes of securing money they never received. In truth, no official compensation exists. Scammers used that gap to harvest names, dates of birth and National Insurance numbers. Once they had this data, they launched further fraud attempts.

How it Works

At first glance, the fake calculator looks legitimate. It carries Martin Lewis’s photo and quotes about pension rights. A banner claims, “Check your WASPI compensation now.” Women submit basic information by clicking through smooth, friendly pages. They may even receive an email that mimics the look of a government notice.

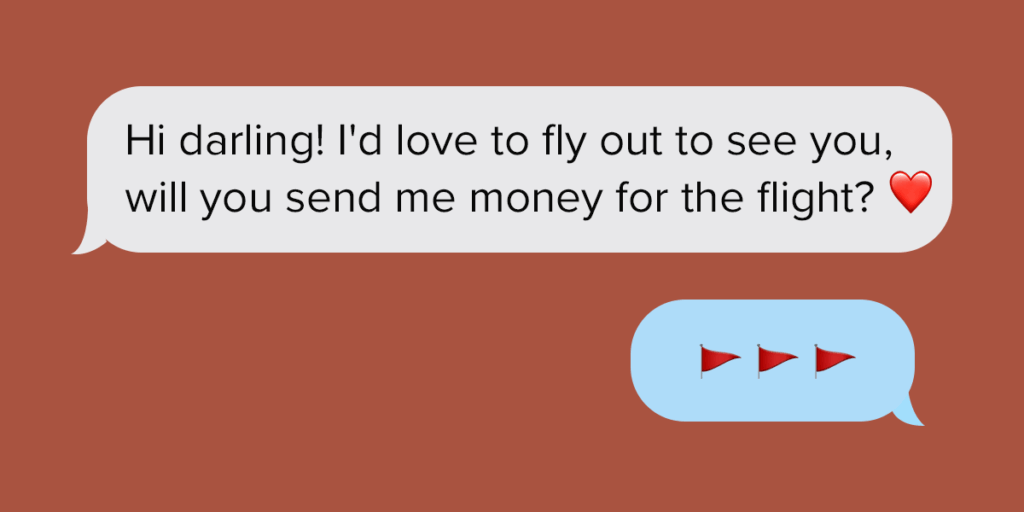

Behind the scenes, fraudsters capture every input. They then sell this data on the dark web or use it to craft more sophisticated attacks. Victims soon receive phishing texts or cold calls that appear tailored to their situation. Some hear a taped recording of a “financial adviser” who knows their full name. This illusion of trust convinces people to share bank details or pay upfront fees.

No legitimate process asks for money to reclaim a state pension. You should never install remote-access software to prove your identity. If a form asks for your online banking password, close the page immediately—genuine sites—from GOV.UK to Money Saving Expert—never demand such information.

Expert Tips to Avoid Scams

Protecting your data begins with vigilance. Always type web addresses yourself. Avoid clicking links in social-media adverts, even if they look official. Look for HTTPS in the browser bar and a padlock icon. Those signs mean the site uses secure encryption.

Watch out for urgent language. Phrases like “Last chance to claim” or “Deadline ends tonight” aim to cloud your judgment. Fraudsters rush you into action. Pause before you click. Step away from the screen and think through what you’re being asked.

Martin Lewis never endorses products through pop-up adverts. His team publishes every genuine article on moneysavingexpert.com. If you see his face somewhere else, assume it’s fake. Check his verified social media channels for the latest fraud warnings.

What to Do If You Fall Victim

Even the most cautious people can slip up. If you suspect you have used a fake WASPI calculator, act fast. First, contact your bank. Ask them to freeze your accounts and block any suspicious transactions. Most banks will investigate and may reverse unauthorised payments.

Next, report the scam to Action Fraud. Their online reporting tool captures details about the incident. Include screenshots and any contact names or numbers you received. This helps the police track the criminals behind the scheme. Change your passwords immediately. Start with your email and online banking, then move on to shopping and social media accounts. Monitor your credit report each month for any new accounts you did not open. Free monitoring services can send you alerts if anyone attempts to use your identity.

Scammers adapt quickly, but so can you. By spotting warning signs and verifying every link, you stay one step ahead. Trust only official sources for financial advice. Visit GOV.UK for state pension details and Money Saving Expert for Martin Lewis’s genuine guides.

Share what you learn with friends and family. A quick message or phone call can stop someone you care about from falling victim. Fraud prevention relies on community awareness. Martin Lewis has spent decades helping people make smarter money choices. He continues to warn against the latest scams. Follow his advice, stay alert and report any suspicious activity. That way, you protect more than your savings—you protect everyone around you.