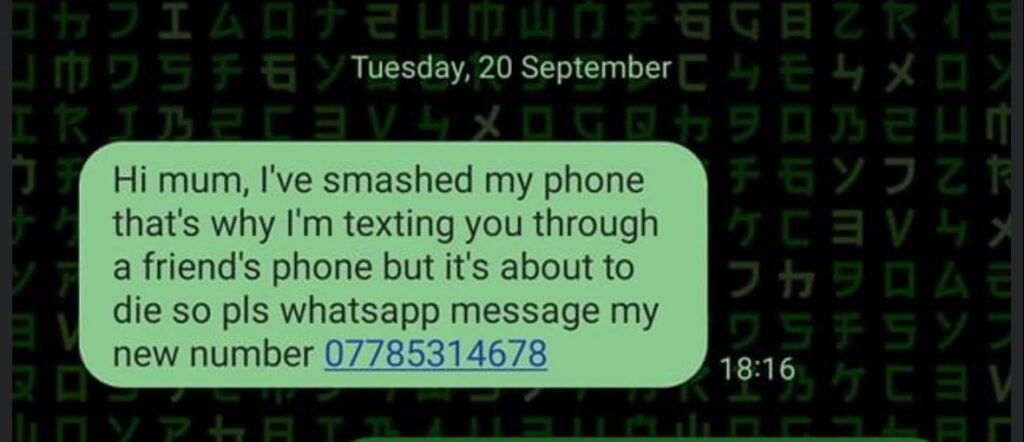

Parents across the UK face a rising tide of “Hi Mum” WhatsApp scams where fraudsters pose as children or family members who have lost their phones or can’t access their bank accounts. They send a simple WhatsApp message: “Hi mum” or “Hi dad.” That friendly opening hooks the victim. Soon, they ask for money to cover rent, phone replacement or urgent bills. These scams are now evolving at breakneck speed, putting more families at risk.

Evolving Tactics

WhatsApp scams usually begin with a casual greeting. The scammer claims they have lost/broken their phone or forgot their PIN. They then say their bank account is locked. They ask the parent to transfer funds to a new account. That new account does not belong to the real child. Instead, it belongs to the fraudster. Many parents worry about their child’s safety, so they move fast to help, never pausing to verify the request. A simple call back to the real number would stop the scam in its tracks, but many fail to take this precaution.

Fraudsters now use AI to mimic voices and create realistic audio messages. They may send a voice note that sounds just like your child. They can even splice familiar phrases into those clips. Text alone once sufficed. Now, they layer in images, voice notes and urgent timelines. Some scammers impersonate close friends or even parents and chase you across multiple apps and platforms. They switch from WhatsApp to SMS if you block the first number. This adaptability makes them even harder to spot.

Impact on Families

These scams cause real harm. Between 2023 and 2025, victims lost £226,744 to “Hi Mum” texts alone. Santander data shows scams posing as sons succeeded most often, followed by daughters. Parents lost sleep, fearing their child faced danger. Many reported anxiety attacks when they first saw the messages. Some emptied savings accounts before realising the truth. That panic cost them thousands. Even small transfers can leave lasting emotional distress.

Fraud prevention specialists recommend simple checks before you act. Always pause and think. If you see an unexpected request for money, pick up the phone. Call your child on their real number. Do not reply to the message. If they do not answer, wait and try again later. Ask a question only they would know, like the name of their first pet. That trick exposes any imposter.

Set up a shared family password or code word. Agree on it with your child in person. Use it whenever someone asks for money online. If you receive a message without that code, treat it as suspect. You can also enable WhatsApp’s security notifications, which flag changes in contact keys. That alert helps you spot phone number spoofing.

What to Do If You Fall Victim

If you realise you transferred cash to a scammer, act immediately. Contact your bank and ask them to reverse the payment. Explain the situation clearly. Banks can often block scam transfers if they move fast enough. Next, report the scam to Action Fraud online. Provide as many details as possible, including screenshots and phone numbers. That information helps police track down fraudsters.

You can also report scam WhatsApp messages directly within the app. Tap the contact name, scroll to “Report Contact”, and follow the prompts. For scam texts, forward them to 7726. That code sends the message to all UK mobile network providers. They work together to block those numbers.

Finally, seek emotional support if the ordeal leaves you shaken. Talking to friends, family, or a counsellor can ease anxiety. Many community groups offer free helplines for older adults, so you do not have to face the aftermath alone. Fraudsters adapt quickly, but clear thinking still beats their tactics. When you stay alert, you protect both your money and your peace of mind.