Romance scam reports jumped 20% year-over-year in Q1 2025, according to Barclays. The bank analysed its fraud data and found most scams began on online dating sites and apps. In fact, the majority of first-quarter reports came directly from these platforms. Barclays also noted that 12% of UK adults have either fallen victim to a romance scam or know someone who has. These figures show how far scammers are willing to go to exploit our trust in digital matchmaking services.

Scammers follow the crowd. As more people meet online, fraudsters target those spaces. Barclays’ fraud expert Kirsty Adams explained that social media and dating apps now lead the way as the fraudsters preferred vehicle for their romance scams. She said scammers adapt to new channels, using them to build fake profiles and manipulate victims. Their tactics play on loneliness and the desire for connection. In many cases, the scammer begins asking for money within a few weeks, long before true friendship or love can form.

The Rising Cost of Romance Scams

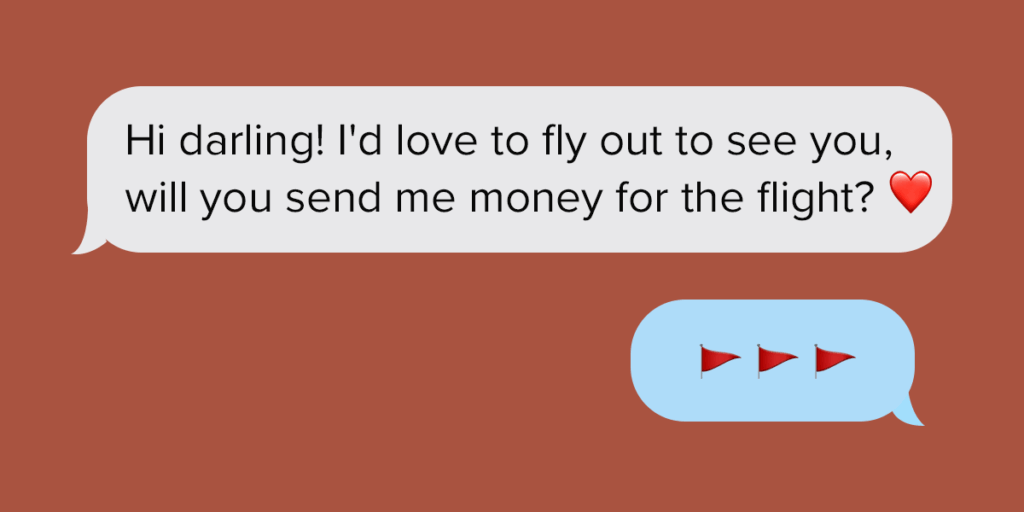

Average losses from romance fraud climbed from £5,800 in 2023 to £8,000 in 2024. Older victims faced steeper losses. People aged 61 and over lost an average of £19,000 in 2024. These seniors often lack digital know-how, making them prime targets. Moreover, men now represent 60% of scam victims and account for 57% of total money lost. This shift suggests scammers tailor their pitch to different demographics, drawing on stereotypes and emotional needs. Victims report a range of urgent demands. Barclays found that 39% of romance scams involve money requests within the first month of chatting. Scammers then use specific excuses to pressure their targets, including:

- Fake emergencies (32%)

- Travel costs for flights or visas (26%)

- Medical bills or hospital fees (26%)

Most romance fraud cases would vanish if we follow one simple rule: never send money to someone you meet online. Scammers excel at manipulating emotions, crafting urgent tales to spur a quick transfer. Staying firm on this rule stops them in their tracks. You avoid financial loss and save yourself untold stress. That single decision preserves both your savings and your peace of mind. It prevents heartbreak from deceit and avoids the agony of betrayal. Remember this rule, share it with friends, and build a community resilient to romance fraud.

How Scammers Pressure Victims

Once scammers gain trust, they push victims harder. They weave convincing stories about personal crises and will claim to have a sick relative or a legal problem. They follow up with multiple payment requests, often via gift cards or bank transfers. Victims feel trapped by the urgency and fear of losing their new “partner.” In fact, 19% of victims admit they ignored warning signs because they were excited about love. This emotional hook shorts-circuits their judgment.

Adding to the danger, fraud networks often trade stolen information. Once one scammer exhausts a victim, they sell or share her details with other criminals. That victim may then face a follow-up scam—perhaps a fake legal claim or a false job offer. This coordinated approach magnifies the harm and makes recovery harder.

Raising Awareness

Wider public education offers the best defence against romance scams. Banks, regulators, and community groups must join forces. They can hold free workshops at libraries and community centres, teaching seniors how to spot red flags. Clear, jargon-free guides—shared via social media—can reach younger audiences. Government agencies should mandate fast refunds for scam victims to ease financial stress. When we raise awareness, we make it harder for fraudsters to find vulnerable targets.

As romance scams evolve, so must our defences. By staying alert and following expert advice, we protect both our hearts and our wallets. Everyone deserves a safe path to true connection. With better platform safeguards, informed users, and swift law enforcement action, we can make romance scams a thing of the past.