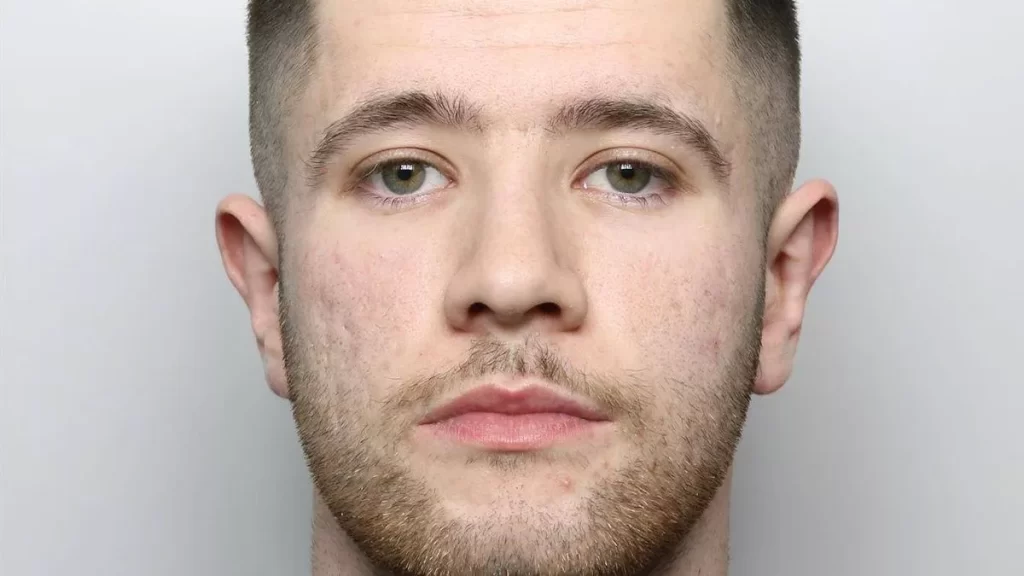

Zak Coyne, a 24-year-old computer expert from Huddersfield, ran LabHost and used his technical skills to steal millions of pounds. He played a central role in creating LabHost—a website that served as a one-stop shop for fraudsters. LabHost offered a subscription service, allowing criminals to design realistic copies of well-known websites. These fake sites mimicked brands like Amazon, Netflix, and 26 UK banks. Fraudsters used these pages to steal confidential customer data and trick innocent people into entering personal information. The operation helped fraudsters impersonate trusted institutions, leading to large-scale theft and financial loss.

LabHost enabled criminals to commit fraud on an extraordinary scale. In an industry where many fraudulent schemes go unnoticed, LabHost stood out as a professional and sophisticated tool. Thousands of fraudsters subscribed to the platform, confident that they could easily dupe unsuspecting victims and avoid detection.

How LabHost Operated

LabHost worked by providing criminals with access to a range of ready-made phishing pages. These pages closely resembled genuine websites, and they fooled victims into thinking they were accessing secure accounts. When victims entered their details, fraudsters captured sensitive information and sold it on the black market. Experts in cyber security point out that such fake websites make it nearly impossible for victims to spot the difference. The design, logos, and even the URLs were almost identical to those of the real companies.

Zak Coyne, who co-created LabHost with an unidentified Canadian partner in 2021, took charge of the UK operations. As the primary administrator, he managed the “world membership support account” and provided ongoing assistance to subscribers. LabHost did not limit its offerings to just creating phishing pages; it also supplied training materials such as video tutorials. These tutorials taught criminals how to refine their techniques and avoid detection by law enforcement.

The platform quickly became popular among criminals worldwide. Subscribers relied on LabHost to set up their fraudulent schemes with ease. With nearly 13,000 users before authorities shut the site down, it established a solid foothold in the fraud landscape. The service even allowed criminals to target millions in other countries, making it a global threat. Victims fell prey to the scam by entering their banking, commercial, or government website credentials.

Global Impact and Financial Losses

The financial damage caused by LabHost was staggering. In the United Kingdom alone, losses reached £100 million, according to figures presented at Minshull Street Crown Court. However, these losses only represent a fraction of the global impact. Experts have estimated that potential losses could run into multiple billions if all affected transactions are considered. In Canada, losses could total up to £523 million, in Ireland up to £125 million, and in Australia around £64 million. When aggregated, the potential global loss might reach as high as £12 billion.

LabHost stole a vast amount of personal data. Investigators noted that the platform had compromised 429,114 credit card numbers, 887,609 unique passwords, and 62,532 unique mother’s maiden names. These figures indicate the sheer scale at which the platform operated.

International Law Enforcement

The takedown of LabHost followed a massive and coordinated investigation that brought together law enforcement agencies from across the globe. Europol, the Crown Prosecution Service, the Metropolitan Police, and partners from Canada, the US, Australia, and several European nations collaborated on the operation. This international effort highlighted the critical role of cross-border cooperation in fighting fraud. When faced with criminals who operate without regard for national boundaries, law enforcement must work together to dismantle their networks.

Authorities tracked digital footprints and used advanced blockchain analytics to trace transactions. Their work uncovered the full extent of LabHost’s reach. The global investigation not only led to the shutdown of the platform but also resulted in the arrest of Zak Coyne. He was taken into custody after being apprehended in the departures area at Manchester Airport in April of the previous year. During the investigation, law enforcement seized evidence and digital records that directly tied Coyne to the operation.

Successful operations like this send a clear message to fraudsters. Commander Stephen Clayman of the Metropolitan Police stressed that the outcome of this case demonstrates the commitment of law enforcement agencies to identify and hold accountable those who enable fraudulent activities online. He warned that authorities would continue to pursue individuals who facilitate these criminal functions, regardless of their location or methods.

Sentencing of Zak Coyne

During the sentencing hearing at Minshull Street Crown Court, Judge Jenny Lester-Ashworth described LabHost as “one of the most professional and sophisticated websites in the world for committing online fraud.” She noted that Zak Coyne enjoyed participating in the criminal underworld. His deep involvement in the cybercrime network left many victims feeling unsafe online. The fraudster’s operation not only cost victims substantial sums of money but also inflicted significant emotional distress.

Prosecutors explained how LabHost allowed a vast number of criminals to bypass conventional security measures. Simon Gurney, the prosecutor, stated that while it is impossible to determine the exact figure for the total losses, the court was confident that the losses exceeded £100 million. He added that the overall risk and potential losses from the frauds committed through LabHost could be measured in multiple billions of pounds.

Coyne’s role was integral. He managed the primary support system for subscribers and earned around £200,000 from his activities. Although he received his earnings in cryptocurrency, he converted these digital funds into cash with the help of a third party. When Coyne later distanced himself from LabHost, the service ceased functioning and remained offline for two months. However, he quickly launched a new competitor phishing site to fill the gap, demonstrating his continuous commitment to the fraudulent business.

Lessons Learned

The LabHost case serves as a crucial lesson in digital security and enforcement. Experts advise that financial institutions must strengthen their anti-phishing measures. Banks should invest in advanced fraud detection systems and provide customers with clear guidelines on how to identify phishing attempts. These institutions play a pivotal role in safeguarding customer data and maintaining public trust.

For everyday users, staying informed about the latest fraud tactics remains essential. Experts suggest that consumers always verify website authenticity before entering sensitive details. They should check URLs carefully, use secure connections, and enable multi-factor authentication wherever possible. Keeping software up-to-date also reduces the risk of falling victim to cyberattacks.

Community awareness and education can further strengthen defences against online fraud. Workshops and online courses can help the public recognise the tactics used by fraudsters. By sharing knowledge and experiences, communities can build resilience against such scams. Such initiatives reduce victimisation and empower individuals to protect their personal information.

The LabHost case illustrates how a small group of individuals can leverage technology to cause global damage. Zak Coyne’s role in developing and managing this sophisticated phishing platform resulted in losses that may exceed billions. The international collaboration that led to his arrest also demonstrates that law enforcement agencies are continually evolving and adapting to the challenges of fraud. As digital transactions become increasingly common, the importance of robust online security measures cannot be overstated. Financial institutions, regulators, and everyday users must all take active steps to counter the threat of fraud.